Bank of Khyber (BOK) is a major Pakistani and one of the major financial institutions that have unveiled an enticing list of their 2025 career opportunities in various cities. The Pakistani banking sector continues to record a strong growth rate with the entire industry recording high levels of profits in the number of over PKR 600 billion in 2024 making BOK a perfect employer with attractive packages and great career growth opportunity.

The bank that has declared its record profit of PKR 3.61 billion in 2024 (a massive growth when compared to the past) is already facilitating hiring of employees in its main areas such as Branch Managers, Team Leaders, Relationship Managers, as well as in the special functions. This is part of the strategic growth effort of BOK that endeavors to sustain its status as one of the top most Islamic and conventional banking institution in Pakistan.

The KPMG Pakistan Banking Perspective 2025 also suggests that the Pakistan banking industry will continue growing, with the Net Interest Income potentially hitting US$55.91 billion, generating significant amounts of workplaces to the skilled specialists.

What Positions Are Currently Available at Bank of Khyber?

Bank of Khyber’s latest recruitment announcement encompasses nine distinct career opportunities across various experience levels and specializations:

Management and Leadership Roles

Team Leader – Commercial & SME

Locations: Lahore, Multan, Sialkot and nearby areas

Application Deadline: July 27, 2025

Key Focus: Leading small and medium enterprise banking initiatives and commercial banking operations

Relationship Manager – Corporate, Commercial & SME

Locations: Faisalabad, Islamabad, Karachi, Lahore, Multan, Peshawar, Sialkot and surrounding areas

Application Deadline: July 27, 2025

Primary Responsibilities: Managing high-value client relationships and driving business growth

Branch Manager Positions

Available Locations:

- Shangla (Puran) – Closing July 27, 2025

- Swat (Madyan) – Closing July 27, 2025

- Burewala – Closing August 2, 2025

Essential Functions: Overall branch operations management, staff supervision, and achieving business targets

Specialized Professional Roles

Head Financial Budgeting & MIS Division

Location: Head Office – Peshawar

Application Deadline: August 2, 2025

Department: Finance Group

Scope: Strategic financial planning and management information systems oversight

Officer Customer Due Diligence

Location: Head Office – Peshawar

Application Deadline: August 2, 2025

Department: Customer Due Diligence Department

Focus: Compliance and risk management functions

Shariah Expert – Shariah Compliance Division

Location: Head Office – Peshawar

Application Deadline: August 2, 2025

Specialization: Islamic banking compliance and advisory services

Operations and Service Roles

Branch Operations Manager

Location: Bajaur

Application Deadline: August 2, 2025

Responsibilities: Operational efficiency and process management

Branch Services Officers

Locations: Lower Dir, Upper Dir, Bajaur

Application Deadline: August 2, 2025

Function: Customer service excellence and branch support operations

What Are the Salary and Benefits Expectations for Bank of Khyber Employees?

Bank of Khyber has competitive remunerations as per the industry. Considering Glassdoor and PayScale information, and coupled with BOK policy of providing “market-based remuneration,” here is a complete break down:

Salary Ranges by Position (PKR Monthly)

| Position Level | Entry Range | Mid-Level | Senior Level | Experience Required |

|---|---|---|---|---|

| Branch Services Officer | 35,000 – 45,000 | 50,000 – 65,000 | 70,000 – 85,000 | 0-3 years |

| Team Leader | 60,000 – 75,000 | 80,000 – 100,000 | 110,000 – 130,000 | 3-6 years |

| Relationship Manager | 55,000 – 70,000 | 75,000 – 95,000 | 100,000 – 125,000 | 2-5 years |

| Branch Manager | 80,000 – 100,000 | 110,000 – 140,000 | 150,000 – 200,000 | 5-10 years |

| Head of Division | 150,000 – 200,000 | 220,000 – 280,000 | 300,000 – 400,000 | 10+ years |

Comprehensive Benefits Package

According to AmbitionBox and employee reviews, Bank of Khyber provides exceptional benefits:

Core Benefits:

- Annual Leaves: 15 days with Leave Fare Assistance (LFA)

- Life Insurance: Comprehensive coverage including unique policies

- Medical Coverage: Health insurance for employee and family

- Performance Bonuses: Annual performance-based incentives

- Provident Fund: Retirement savings with employer contribution

Additional Perks:

- Career Development: Training programs and skill enhancement

- Loan Facilities: Staff loans at preferential rates

- Housing Support: Accommodation allowances or provided housing

- Transport Facilities: Commutation support in major cities

Industry Comparison Analysis

Bank of Khyber’s compensation structure compares favorably with industry leaders:

| Bank | Average Salary (PKR/Month) | Benefits Rating | Growth Opportunities |

|---|---|---|---|

| Bank of Khyber | 45,000 – 150,000 | 4.2/5 | Excellent |

| HBL | 50,000 – 160,000 | 4.0/5 | Very Good |

| MCB Bank | 48,000 – 155,000 | 4.1/5 | Very Good |

| UBL | 46,000 – 145,000 | 3.9/5 | Good |

What Qualifications and Experience Do You Need?

Bank of Khyber maintains clear educational and experience standards that reflect industry best practices:

Educational Requirements

Minimum Standards:

- Bachelor’s Degree: Required from HEC-recognized Pakistani universities

- Master’s Degree: Strongly preferred for management positions

- Professional Qualifications: Additional advantage for relevant certifications

Field Preferences:

- Business Administration (MBA/BBA)

- Finance and Accounting (CA, ACCA, CMA)

- Economics and Banking

- Islamic Studies (for Shariah compliance roles)

- Information Technology (for technical positions)

Experience Requirements by Role

Entry-Level Positions (Branch Services Officers):

- Fresh graduates to 2 years experience

- Banking industry exposure preferred

- Customer service orientation essential

Mid-Management Roles (Team Leaders, Relationship Managers):

- 3-6 years banking or financial services experience

- Sales and relationship management background

- Leadership and team management skills

Senior Management (Branch Managers, Division Heads):

- 5-15 years progressive banking experience

- Proven track record in target achievement

- Strategic planning and execution capabilities

Special Requirements and Preferences

Foreign Degree Holders:

- Must provide HEC equivalency certificate at interview

- Additional documentation may be required for verification

Preferred Candidates:

- Islamic Banking experience highly valued

- Digital Banking knowledge increasingly important

- Regulatory Compliance understanding preferred

- Multi-lingual capabilities advantageous

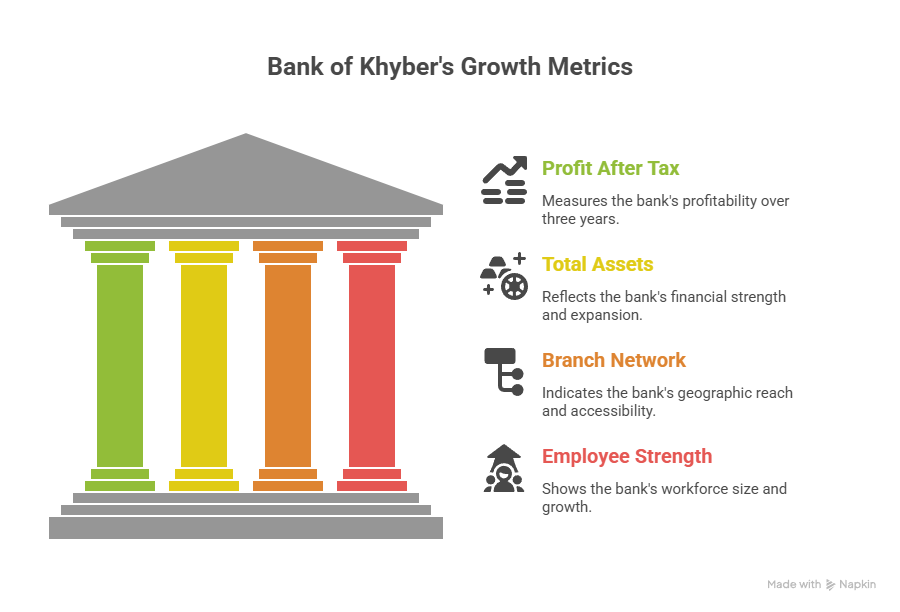

How Is Bank of Khyber Performing Financially?

Understanding BOK’s financial strength provides insight into job security and growth prospects:

2024 Financial Highlights

Record-Breaking Performance:

- Profit After Tax: PKR 3.61 billion (2024)

- Total Assets: PKR 360.44 billion

- Revenue Growth: 28% increase in nine-month profit before tax

- Capital Adequacy Ratio: 18.25% (well above regulatory requirements)

Market Position and Credit Ratings

Credit Rating Upgrade:

- Long-term Rating: Upgraded to AA- by VIS Credit Rating

- Short-term Rating: A1 with Stable Outlook

- Market Confidence: Strong institutional backing and growth trajectory

Industry Context

According to Statista Market Forecast and World Bank data:

- Pakistani banking sector Net Interest Income projected at US$55.91 billion for 2025

- BOK ranks among top performing banks in Pakistan

- Steady deposit growth indicating customer confidence

- Strategic expansion in digital banking services

Growth Trajectory Analysis

| Performance Metric | 2022 | 2023 | 2024 | Growth Trend |

|---|---|---|---|---|

| Profit After Tax (PKR Billion) | 2.8 | 3.48 | 3.61 | ↗ Consistent Growth |

| Total Assets (PKR Billion) | 320 | 345 | 360.44 | ↗ Strong Expansion |

| Branch Network | 180+ | 195+ | 210+ | ↗ Geographic Growth |

| Employee Strength | 3,200+ | 3,500+ | 3,800+ | ↗ Workforce Expansion |

Why Choose Bank of Khyber for Your Banking Career?

Several compelling factors make BOK an attractive employer in Pakistan’s competitive banking landscape:

Institutional Strengths

Dual Banking Model:

- Islamic Banking expertise and leadership

- Conventional Banking services and products

- Market diversification reducing business risks

- Customer choice and market penetration

Technology and Innovation:

- Digital Banking platform investments

- Mobile Banking application development

- Online Services expansion

- Fintech Partnerships and collaborations

Career Development Opportunities

Professional Growth:

- Internal Promotion policies favoring existing employees

- Training and Development programs regularly conducted

- Cross-functional exposure and learning

- Leadership Development initiatives

Industry Recognition:

- Award-winning customer service programs

- Regulatory Compliance excellence

- Corporate Governance best practices

- Social Responsibility initiatives

Work Environment and Culture

Based on employee reviews from Glassdoor and Indeed:

Positive Aspects:

- Collaborative team environment (4.1/5 rating)

- Management support for career growth

- Work-life balance initiatives

- Equal opportunity employment practices

Core Values Implementation:

- Integrity in all business dealings

- Professionalism in customer service

- Innovation in banking solutions

- Team Work across all departments

How Can You Apply for These Positions?

Bank of Khyber has streamlined its application process to ensure accessibility and efficiency:

Application Methods

Primary Application Channel:

- Website: www.bok.com.pk/careers

- Online Application: Complete digital submission process

- Document Upload: CV, certificates, and supporting documents

Alternative Application Method:

- Postal Address: Head Human Resourcing Division, 3rd Floor, BOK HO Tower, 24-The Mall, Peshawar Cantt

- Physical Submission: CV with covering letter

Application Timeline

Critical Dates:

- July 27, 2025: Final deadline for Team Leader, Relationship Manager, and Branch Manager positions (Shangla/Swat)

- August 2, 2025: Final deadline for Head of Division, Specialized, and Operations roles

Selection Process Timeline:

- Application Review: 1-2 weeks post-deadline

- Shortlisting: Merit-based candidate selection

- Interview Notification: Direct communication to shortlisted candidates

- Interview Process: Location-specific scheduling

- Final Selection: Merit-based appointment

Required Documentation

Mandatory Documents:

- Updated CV with complete employment history

- Educational Certificates (all degrees and diplomas)

- Experience Letters from previous employers

- CNIC Copy and recent photographs

- Professional Certifications (if applicable)

Special Requirements:

- HEC Equivalency Certificate for foreign degree holders

- Character Certificate from previous employer

- Medical Fitness certification (post-selection)

Important Application Guidelines

Key Reminders:

- No TA/DA provided for interview attendance

- Merit-based selection strictly followed

- Equal opportunity employer status maintained

- Special needs persons encouraged to apply

- Women candidates strongly encouraged

What Are the Career Advancement Prospects?

Bank of Khyber offers clear pathways for professional growth within Pakistan’s expanding banking sector:

Internal Career Progression

Typical Career Path:

- Entry Level: Officer/Executive positions

- Mid-Level: Senior Officer/Assistant Manager roles

- Management: Manager/Deputy Manager positions

- Senior Management: General Manager/Chief positions

- Executive Leadership: Head of Division/Chief Officer roles

Skill Development Opportunities

Training Programs:

- Technical Skills: Banking operations and regulations

- Leadership Development: Management and supervisory skills

- Digital Literacy: Technology and innovation training

- Islamic Banking: Shariah compliance and products

Professional Certifications:

- Institute of Bankers Pakistan (IBP) certifications

- Risk Management and compliance programs

- Digital Banking and fintech training

- International Banking qualifications

Industry Growth Statistics

According to Pakistan Bureau of Statistics and State Bank of Pakistan:

- Banking Sector Employment: Growing at 8-10% annually

- Digital Banking Jobs: Increasing by 15-20% yearly

- Islamic Banking Roles: Expanding at 12-15% annual rate

- Management Positions: 25% increase in demand over 2024-2025

What Makes This Recruitment Drive Unique?

Several factors distinguish BOK’s current hiring initiative:

Geographic Coverage

Multi-City Presence:

- Major Urban Centers: Karachi, Lahore, Islamabad, Faisalabad

- Regional Hubs: Peshawar, Multan, Sialkot

- Emerging Markets: Shangla, Swat, Bajaur, Dir districts

Strategic Expansion:

- Northern Pakistan branch network growth

- Rural Banking initiatives

- Digital Banking infrastructure development

Diversity and Inclusion

Equal Opportunity Commitment:

- Gender Equality: Women strongly encouraged to apply

- Special Needs: Persons with disabilities welcomed

- Merit-Based Selection: Transparent recruitment process

- Cultural Diversity: Multi-regional representation

Market Timing Advantage

Industry Context:

- Economic Recovery: Pakistan’s GDP growth projected at 2.6-3.6% for 2025

- Banking Sector Growth: Consistent expansion in financial services

- Digital Transformation: Increased technology adoption

- Regulatory Support: Favorable banking sector policies

Conclusion: Secure Your Future with Bank of Khyber

The thorough-going recruitment drive by Bank of Khyber is the best of opportunities, which a professional in pursuit of satisfactory careers in the booming banking industry of Pakistan may avail. BOK will provide employees with job security and growth potential with record profit of PKR 3.61 billion in 2024, credit rating up gradation, and strategic expansion plans.

Key Opportunity Highlights:

- Nine distinct positions across various experience levels

- Competitive salaries ranging from PKR 35,000 to PKR 400,000+ monthly

- Comprehensive benefits including insurance, provident fund, and career development

- Geographic diversity with positions in major cities and emerging markets

- Clear advancement paths within Pakistan’s expanding banking industry

Critical Action Steps:

- Review Position Requirements against your qualifications and experience

- Prepare Complete Documentation including all certificates and experience letters

- Submit Applications Early through www.bok.com.pk/careers

- Meet Application Deadlines: July 27 or August 2, 2025

- Prepare for Merit-Based Selection process

Deadline: Management positions deadline is July 27, 2025 and August 2, 2025 is the deadline of specialized applications. This is your chance to become part to one of the most successful banking institutions in Pakistan.

Apply Now: Visit Bank of Khyber Careers Portal to submit your online application and take the first step toward a rewarding banking career.

Sources and References

- Bank of Khyber Official Careers Page

- BOK Annual Report 2024

- KPMG Pakistan Banking Perspective 2025

- Pakistan Banking Sector Statistics – Statista

- Bank of Khyber Financial Performance – Business Recorder

Last Updated: July 19, 2025 | Application Deadlines: July 27 – August 2, 2025

Frequently Asked Questions

What kind of jobs are offered by Bank of Khyber in 2025?

BOK is offering jobs in banking, finance, IT, and branch operations.

Can candidates from all over Pakistan apply?

Yes, candidates from any city in Pakistan can apply online.

Is online application mandatory for BOK jobs?

Yes, all applications must be submitted through the official BOK careers portal.

Is banking experience required for every position?

Not all jobs require experience; fresh graduates can apply for entry-level roles.

Is Bank of Khyber a government bank?

Yes, it is a provincial government bank owned by the Government of Khyber Pakhtunkhwa.